From Reactors to Returns: The Economics of Nuclear Power in 2025

Nuclear power remains the world’s most misunderstood energy asset — a paradox of stability and stigma. It supplies a constant stream of low-carbon electricity while anchoring national energy security. Yet, in 2025, its infrastructure and influence are concentrated in a few hands.

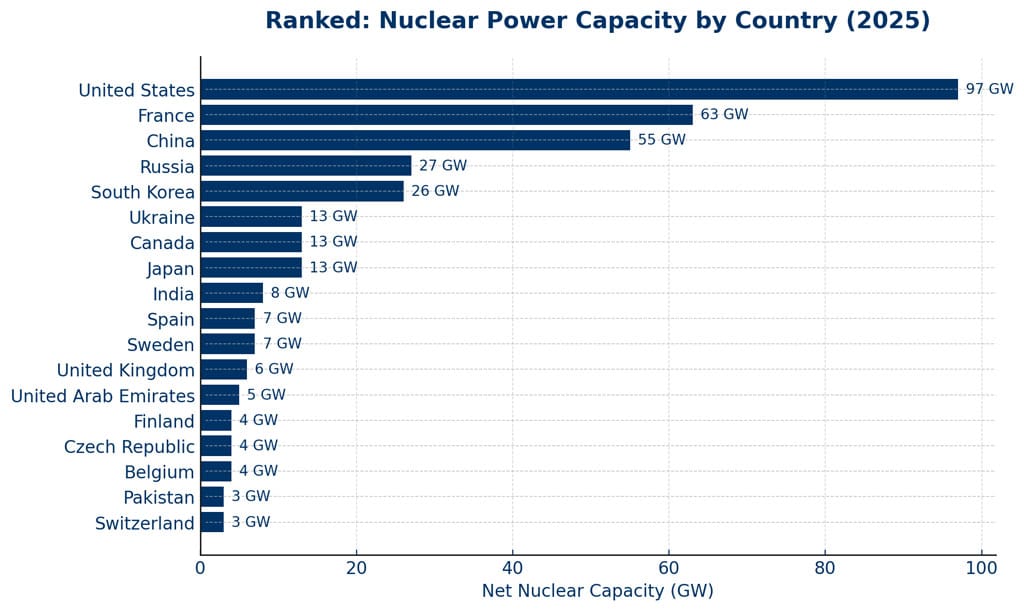

According to CEOWORLD magazine’s analysis, five countries control more than 70 percent of the world’s nuclear generation capacity — a reality that speaks to decades of industrial policy, technological investment, and strategic foresight.

Innovation Frontier — SMRs and Fusion Futures: The next wave of atomic power is smaller, smarter, and far more modular. Small Modular Reactors (SMRs) — from Rolls-Royce, NuScale, and GE Hitachi — promise factory-built scalability, lower upfront capital, and flexible deployment for industrial parks, data centers, and remote regions.

Meanwhile, fusion energy is edging from science fiction toward commercial proof-of-concept. Startups like Commonwealth Fusion Systems and Helion Energy, backed by billionaires from Silicon Valley to Wall Street, are racing to deliver net-positive plasma within the next decade. For the private market, this signals a historic opening: nuclear innovation transitioning from state monopoly to venture opportunity.

Below, we rank the global leaders shaping the atomic energy landscape — and examine what their dominance reveals about the future of power, politics, and profit.

Ranked: Nuclear Power Capacity by Country (2025)

| Rank | Country | Number of Reactors | Net Capacity (GW) |

|---|---|---|---|

| 1 | United States | 94 | 97 |

| 2 | France | 57 | 63 |

| 3 | China | 57 | 55 |

| 4 | Russia | 36 | 27 |

| 5 | South Korea | 26 | 26 |

| 6 | Ukraine | 15 | 13 |

| 7 | Canada | 17 | 13 |

| 8 | Japan | 14 | 13 |

| 9 | India | 21 | 8 |

| 10 | Spain | 7 | 7 |

| 11 | Sweden | 6 | 7 |

| 12 | United Kingdom | 9 | 6 |

| 13 | United Arab Emirates | 4 | 5 |

| 14 | Finland | 5 | 4 |

| 15 | Czech Republic | 6 | 4 |

| 16 | Belgium | 4 | 4 |

| 17 | Pakistan | 6 | 3 |

| 18 | Switzerland | 4 | 3 |

United States — 97 GW | 94 Reactors

America’s Enduring Nuclear Backbone

The United States continues to reign as the global nuclear superpower, operating 97 gigawatts of capacity across 94 reactors, accounting for roughly one-fifth of the nation’s total electricity.

While most of the U.S. fleet was built between the 1970s and 1990s, aggressive license extensions and modernization programs are keeping reactors viable well past 2050. The Biden Administration’s Inflation Reduction Act introduced a $6 billion production credit to preserve and extend nuclear output — a clear acknowledgment that decarbonization without nuclear is mathematically impossible.

Wall Street is watching, too. Institutional investors are rediscovering nuclear’s long-duration cash flows, carbon-credit advantages, and grid-stability premiums. Aging plants are being revalued not as legacy liabilities but as strategic baseload assets.

France — 63 GW | 57 Reactors

From the “Messmer Plan” to Macron’s Nuclear Revival

France’s 63 gigawatts of nuclear capacity — roughly 60 percent of its total electricity — reflect a half-century of state-driven engineering discipline. After the 1970s oil shocks, Paris standardized reactor design under the Messmer Plan, creating one of the most reliable and carbon-efficient power grids on Earth.

Today, President Macron’s €50 billion nuclear revival strategy is rebooting the model with six next-generation EPR2 reactors and a pipeline of small modular reactors (SMRs). France’s ambition is clear: to reclaim its role as Europe’s clean-energy anchor and nuclear technology exporter of choice.

The lesson for policymakers: energy independence begins not with ideology but with industrial conviction.

China — 55 GW | Rapid Expansion

The Fastest-Growing Nuclear Fleet on Earth

China has built a 55 GW fleet in less than two decades, and it shows no sign of slowing.

Beijing’s blueprint calls for at least 150 new reactors by 2040, with proprietary Hualong One and CAP1400 designs spreading across Asia, Africa, and the Middle East.

China’s nuclear expansion isn’t just about electrons — it’s about geopolitical leverage and supply-chain dominance. By exporting reactors, financing, and uranium services through the Belt and Road Initiative, Beijing is positioning itself as the indispensable partner for emerging economies seeking stable power.

For global investors, this is industrial policy executed with military precision: energy security as statecraft.

Russia — 27 GW | Rosatom’s Global Empire

The Reactor Merchant of the World

Russia’s 27 GW of domestic nuclear capacity barely captures its real clout. Through Rosatom, Moscow has built a vertically integrated export empire — designing, financing, constructing, and fueling nuclear plants worldwide.

Projects such as Turkey’s Akkuyu, Egypt’s El Dabaa, and Bangladesh’s Rooppur extend the Kremlin’s influence far beyond its borders.

Rosatom controls roughly 40 percent of the global uranium-enrichment market, giving Russia a rare chokehold on a strategic supply chain largely immune to sanctions.

Nuclear power, in the Russian calculus, is foreign policy disguised as infrastructure.

South Korea — 26 GW | Export Excellence

Precision, Pragmatism, and the Barakah Blueprint

South Korea’s 26 GW capacity may look modest, but its influence extends across continents. Through Korea Hydro & Nuclear Power (KHNP), Seoul built the Barakah plant in the UAE — the first commercial nuclear facility in the Arab world — ahead of schedule and within budget.

The Yoon Suk Yeol administration reversed earlier phase-out policies, reaffirming nuclear’s central role in Korea’s net-zero roadmap. The APR-1400 reactor, now an export bestseller, symbolizes the country’s industrial ethos: reliability, repeatability, and relentless execution.

For investors, Korea represents the model of nuclear capitalism without chaos — state alignment with private-sector precision.

Emerging Players — India, Japan, and the Next Wave

Beyond the top five, India (8 GW), Japan (33 GW installed, partial operation), Canada (13 GW), Ukraine (13 GW), and the United Kingdom (6 GW) are shaping nuclear’s next frontier.

India pursues hybrid partnerships with Russia and France while scaling domestic heavy-water reactor designs. Japan, once reluctant post-Fukushima, is cautiously restarting plants amid soaring LNG prices. The U.K. is investing in Hinkley Point C and Sizewell C, blending French technology with sovereign financing. Collectively, these nations illustrate a pivot: nuclear energy is returning not as nostalgia but as strategic necessity.

Strategic Takeaways for Executives and Investors

- Baseload Is Back – As renewables fluctuate and grids strain under AI-era demand, nuclear’s reliability becomes an undervalued premium.

- Regulatory Arbitrage – Markets defining nuclear as “green” under EU taxonomy or U.S. clean-energy credits unlock institutional capital flows.

- Industrial Re-Shoring – Nuclear projects are catalysts for local supply chains, from precision steel to advanced semiconductors.

- Energy Sovereignty – In a multipolar world, control of electrons is control of influence. Nuclear equals leverage.

- Capital Discipline – Successful nuclear investment demands patience, political literacy, and a 30-year horizon — virtues scarce yet rewarded.

The Geoeconomic Reality

The nuclear hierarchy mirrors the global balance of power. Nations atop the table are not merely energy producers; they are architects of global resilience. Their plants light cities, stabilize grids, and underpin industries — from AI cloud infrastructure to heavy manufacturing. In 2025, nuclear energy’s renaissance is not about ideology; it’s about industrial realism. For CEOs and asset allocators, ignoring it is no longer optional.

The atom endures. As carbon markets mature and energy nationalism intensifies, nuclear power has reemerged as the anchor of the 21st-century energy portfolio. The United States defines scale, France defines legacy, China defines momentum, Russia defines export strategy, and South Korea defines precision. Together, they control the future of atomic energy — and, by extension, the economics of stability.

For visionary leaders, the question is no longer if nuclear deserves a seat at the table — but how quickly they can secure theirs.

Have you read?

World’s Best Countries For Business Expats. Safest Cities in the World.

Highest-Paying Jobs in America. World’s Best Cities For Shopping.

Add CEOWORLD magazine as your preferred news source on Google News

Follow CEOWORLD magazine on: Google News, LinkedIn, Twitter, and Facebook.License and Republishing: The views in this article are the author’s own and do not represent CEOWORLD magazine. No part of this material may be copied, shared, or published without the magazine’s prior written permission. For media queries, please contact: info@ceoworld.biz. © CEOWORLD magazine LTD