Leadership in Managing Security Systems and IT Infrastructure at Critical Facilities

Abstract: The article considers the management of security systems and IT infrastructure at critical facilities as a strategic business function, rather than merely an engineering task. It is demonstrated that integrating video surveillance, access control, structured cabling networks, and server-network infrastructure enhances project resilience, mitigates operational risks, and establishes a long-term competitive advantage for the contractor in the international market. Based on global statistics on physical security, video surveillance, and critical infrastructure protection markets, the key requirements for a leader responsible for such systems are analyzed: systems thinking, focus on the facility lifecycle, work in a multinational environment, team building, and transfer of expertise to young professionals.

Critical infrastructure is one of the most complex classes of facilities for managers and engineers. This category includes nuclear and thermal power plants, large industrial complexes, transport hubs, communication infrastructure, water supply, and healthcare facilities. Disruption of their operation entails not only economic but also social, political, and environmental consequences.

In such projects, security systems and IT infrastructure play the role of the facility’s “nervous system”: information about access, perimeter breaches, technological events, and incidents passes through them. However, management practice shows that for a long time, these systems were considered auxiliary — something “necessary to have,” but not a strategic asset.

Global statistics show the opposite.

- The physical security market in 2024 is estimated at approximately USD 131.6 billion, with a forecast of USD 220.4 billion by 2033 (CAGR about 5.6%).

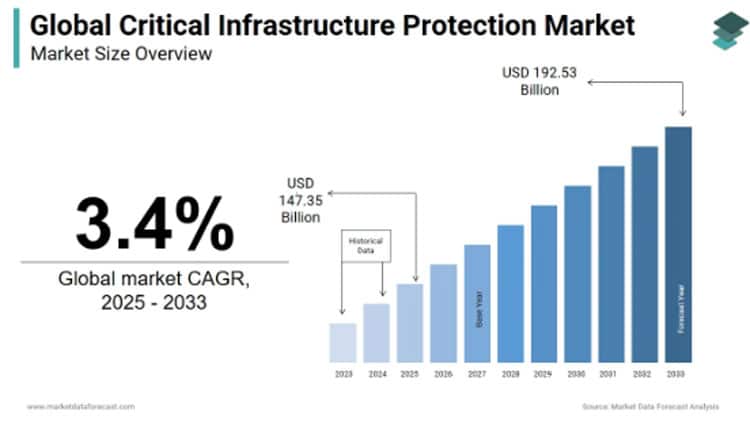

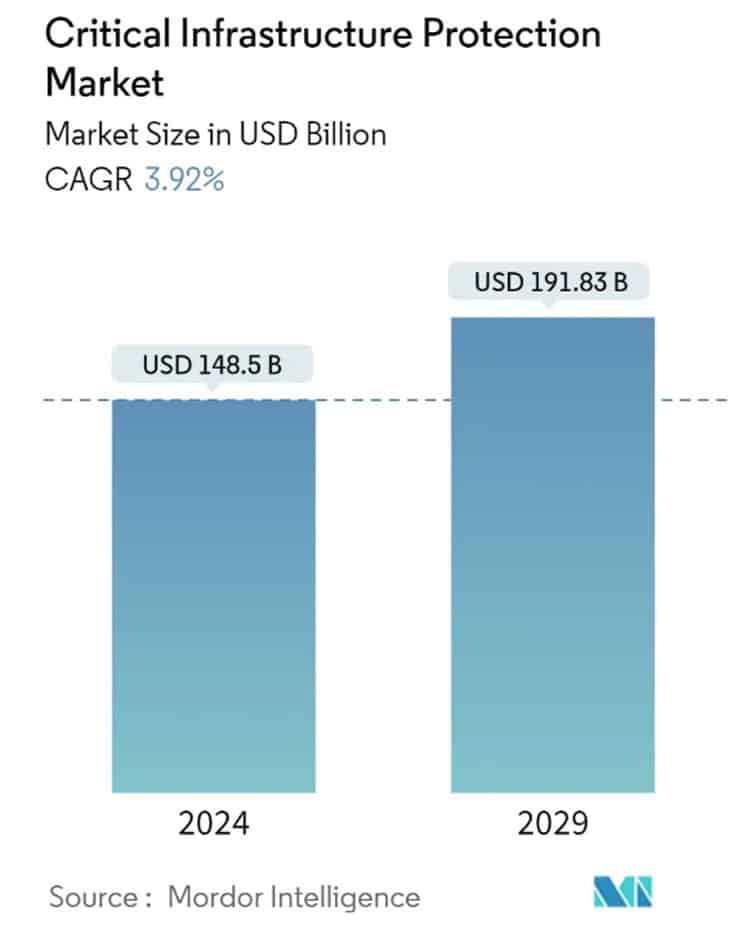

- The critical infrastructure protection (CIP) market reaches about USD 147 billion in 2024 and is projected to grow to USD 192.7 billion by 2033.

- The video surveillance market — a key component of physical security systems — is estimated at USD 73.75 billion in 2024, with a forecast of USD 147.66 billion by 2030 (CAGR about 12.1% from 2025 to 2030).

These figures reflect not only the growth in demand for equipment but also the increasing requirements for managing such systems. In international critical infrastructure projects, the demand for managers capable of combining engineering competence, field installation experience, and strategic management becomes a determining factor for success.

1. Critical Infrastructure: Context for Security Systems and IT

Unlike commercial real estate, where the main criterion is comfort and cost-efficiency of operation, at critical facilities the security system and IT environment are governed by several basic principles:

- Continuity of operation. The permissible frequency and duration of downtime are minimal; even planned stops require careful coordination.

- Multilayered protection. Physical security, access control, cybersecurity, and technological systems are considered as a single circuit.

- Compliance with international and national standards. For projects involving states and large corporations, it is necessary to synchronize the requirements of multiple regulators and industry standards.

In these conditions, video surveillance, access control systems, security alarms, IP telephony, internal communication, and structured cabling networks are not “separate line items” in the budget but elements of the overall facility resilience architecture. The head of the unit responsible for such systems effectively manages one of the key aspects of the project’s operational viability.

2. System Integration as a Management Task, Not Just an Engineering One

Integration of security systems and IT infrastructure is often perceived as a task to “make devices and software platforms work together.” In practice, it is a broader management project, including:

- Development of a target architecture that takes into account the facility lifecycle, possible expansion, and modernization scenarios;

- Selection of technological solutions considering local operating conditions, availability of service support, and resilience requirements;

- Organization of interaction between construction, technological, IT, and operational units.

At large energy construction sites, this implies coordination of a large number of contractors, national and foreign suppliers, as well as future facility operators.

From a business perspective, an integrated architecture provides several key advantages:

- Reduction of total cost of ownership (TCO). Standardization of solutions, cabling infrastructure, rack equipment, and protocols reduces maintenance and modernization costs.

- Improved manageability. A single event monitoring center (video surveillance, access, alarms, technical signals) reduces response time and improves the quality of managerial decisions.

- Scalability readiness. When expanding the facility or constructing new units, integrated solutions allow faster replication of the architecture without losing quality or sharply increasing complexity.

Thus, system integration is not only a matter of equipment compatibility but also a strategic management decision that affects the long-term efficiency of the project.

3. Leadership at the Intersection of Engineering and International Projects

The head of a unit responsible for IT and security systems at an international critical infrastructure facility operates in a specific environment:

- Teams are multinational and include specialists with different experience and engineering backgrounds;

- Management decisions are made within the triangle “state corporation — international contractors — local regulators”;

- Requirements for deadlines and quality are set not only in the contract but also in political and reputational contexts.

In such conditions, leadership implies:

- Systemic vision of the project. Understanding not only one’s own area (video surveillance, structured cabling, access control) but also how this segment integrates into the facility’s overall security model.

- Risk management. Assessing the consequences of delays, installation errors, equipment incompatibility, or integration failures — and timely making compensating decisions.

- Team development. Transferring experience to young specialists, building a structure where operational tasks do not “consume” resources for development, and forming a talent pool for long-term projects.

- Communication with the client. Explaining complex technical solutions in terms of risks, deadlines, and costs, building trust and transparency in work.

Practice shows that in large international construction projects, managers who combine installation experience, engineering knowledge, and readiness to work in a multinational environment quickly move from the role of a regular specialist to unit leadership. Such career growth usually reflects not only individual qualities but also the market’s need for experts capable of connecting technical and managerial dimensions.

4. The Critical Infrastructure Market: Why Security Management Becomes a Strategic Asset

The growth of the global physical security and critical infrastructure protection market is not only an increase in sales of cameras and access control systems. It signals that states and large corporations consider the security and resilience of facilities as an independent strategic priority.

According to IMARC Group, the critical infrastructure protection market grows from USD 147 billion in 2024 to USD 192.7 billion by 2033, against the backdrop of tightening cybersecurity and physical security requirements, development of regulatory frameworks, and rising threats.

At the same time, the physical security market overall moves from USD 131.6 billion in 2024 to USD 220.4 billion by 2033.

The video surveillance segment shows even higher growth rates: from USD 73.75 billion in 2024 to USD 147.66 billion by 2030. This reflects a shift from “point solutions” to analytical and integrated platforms that support real-time decision-making.

For a manager, this means that:

- Competencies in integrating security systems and IT infrastructure become a separate marketable asset;

- Experience in international projects such as nuclear power plants, large industrial facilities, or transport hubs increases the specialist’s value on the global market;

- The ability to build processes, train a team, and ensure repeatable results in different countries becomes a factor of competitiveness for the contractor company itself.

Conclusion: The management of security systems and IT infrastructure at critical infrastructure facilities goes beyond the classic “installation and maintenance.” In modern conditions, it is a complex managerial function, including strategic planning, risk management, integration of heterogeneous systems, interaction with regulators, and team building.

Global statistics on physical security, video surveillance, and critical infrastructure protection markets confirm that this segment is becoming one of the key areas of investment activity for states and corporations. In these conditions, the role of specialists capable of combining engineering depth, field experience, and leadership qualities is increasing.

Leaders who can quickly establish a unit, integrate local systems with new complexes, ensure installation quality and solution durability, and transfer accumulated expertise to young specialists set a new standard for the profession at the intersection of engineering and management. For companies operating in international critical infrastructure projects, the presence of such managers becomes one of the main factors of long-term competitiveness.

References

- IMARC Group. Physical Security Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025–2033.

- IMARC Group. Critical Infrastructure Protection Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025–2033.

- Grand View Research. Video Surveillance Market Size, Share & Trends Analysis Report, 2024–2030.

- MarketsandMarkets. Critical Infrastructure Protection Market by Physical Security, IT and OT Cybersecurity – Global Forecast to 2030.

- Strategic Market Research. Critical Infrastructure Protection Market Size, Share, Forecast 2024–2030.

Written by Pavel Mishchenko, Specialist in IT Infrastructure and Integrated Security of Critical Facilities.

Add CEOWORLD magazine as your preferred news source on Google News

Follow CEOWORLD magazine on: Google News, LinkedIn, Twitter, and Facebook.License and Republishing: The views in this article are the author’s own and do not represent CEOWORLD magazine. No part of this material may be copied, shared, or published without the magazine’s prior written permission. For media queries, please contact: info@ceoworld.biz. © CEOWORLD magazine LTD