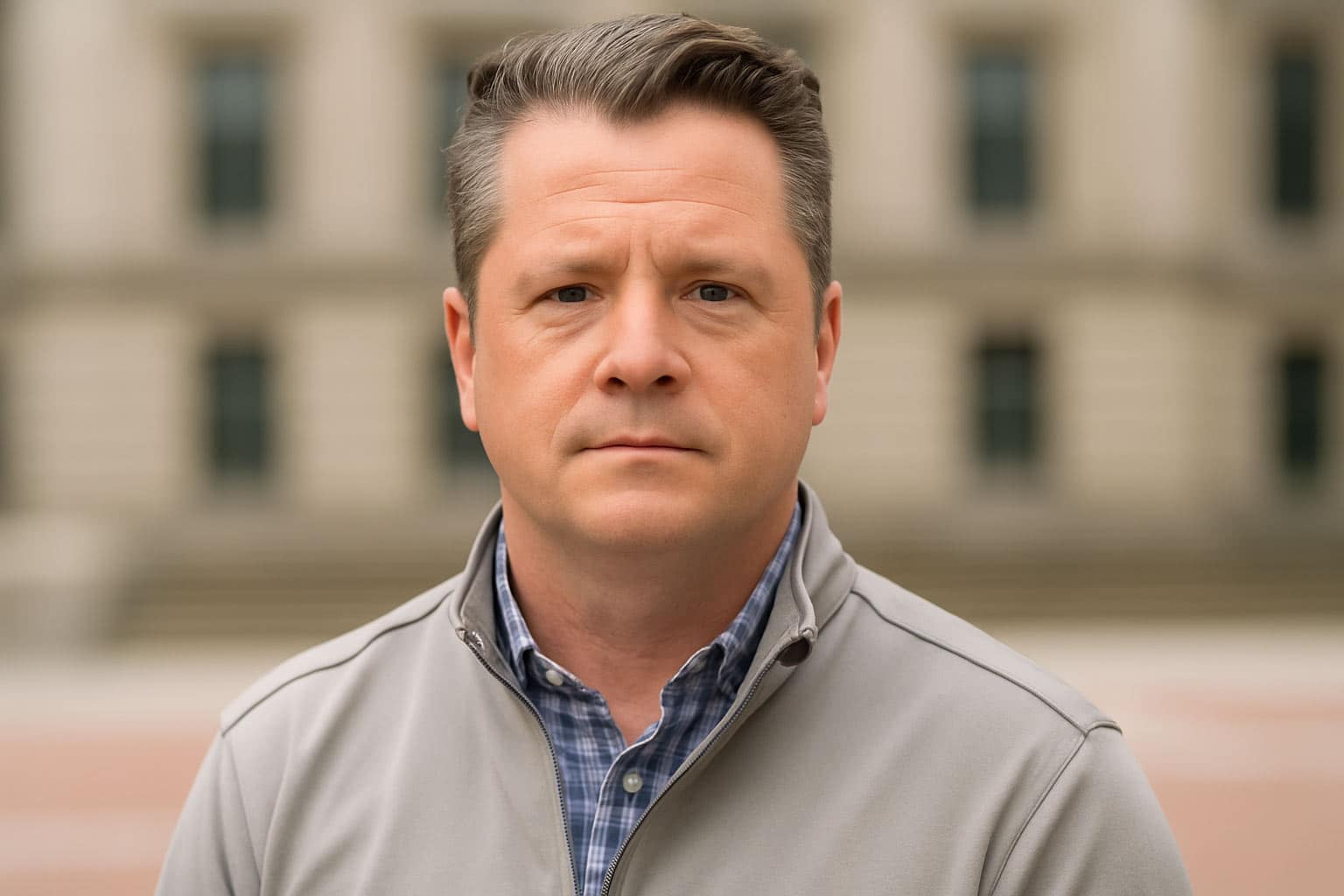

Shane Kinahan: Balancing Wall Street Discipline with Modern Agility

In the fast-moving world of finance, adaptability often separates success from stagnation. For Shane Kinahan, Investment Manager and Principal at Lake Avenue Capital, LLC, that adaptability comes from experience — years on Wall Street, sharpened by a willingness to think differently.

A former Vice President at Goldman Sachs, Kinahan has built his career on combining the rigour of institutional finance with the nimbleness of a boutique firm. “At Goldman, structure and process were everything,” he recalls. “Now, at Lake Avenue, we still value that structure — but we can move faster, take sharper positions, and act on ideas in real time.”

From Wall Street to Stamford: A Career Built on Perspective

Kinahan’s path began like many finance professionals — with ambition, long hours, and a curiosity about how capital shapes the world. Working in one of the world’s most demanding investment environments taught him early lessons about accountability and precision. “You learn quickly that numbers don’t lie,” he says. “The market rewards preparation and punishes complacency.”

After years at Goldman Sachs, Kinahan sought a new challenge — one that allowed him to blend his technical skill with a more entrepreneurial approach. He found that opportunity at Lake Avenue Capital, a Stamford-based investment firm specialising in alternative investments and class action claims.

“Large firms teach discipline,” he explains, “but smaller firms teach creativity. At Lake Avenue, we can see opportunity in places others overlook. We don’t have to wait for approval from five committees — we just do the work.”

Investing Beyond the Conventional

Kinahan’s role focuses on identifying non-traditional investment opportunities — assets and claims that often sit outside the mainstream. Alternative investing, by its nature, requires deep due diligence and a flexible mindset.

“What excites me about alternative assets is the inefficiency,” he says. “There’s no perfect formula. You need to dig, to ask why a market exists the way it does, and what edge you can bring to it.”

That mindset echoes a broader shift across finance. Institutional investors, family offices, and high-net-worth individuals are increasingly diversifying portfolios beyond stocks and bonds. According to Preqin’s 2024 Global Alternatives Report, assets under management in alternatives are projected to exceed $24 trillion by 2027.

Still, Kinahan warns against chasing trends. “Everyone wants the next big thing,” he says. “But the fundamentals still matter — who’s managing the deal, what’s the underlying asset, and how realistic are the returns? Patience is underrated in this business.”

The Value of Agility in Modern Finance

At Lake Avenue Capital, agility isn’t just a buzzword — it’s a business model. Smaller teams allow for faster decision-making and closer collaboration between analysts, managers, and principals. Kinahan believes this structure keeps the firm responsive and grounded.

“In a big bank, you can lose touch with the client’s real needs,” he says. “Here, we talk directly to the people we’re helping. We see the impact of every decision we make.”

He also emphasises that agility doesn’t mean recklessness. “Moving fast doesn’t mean skipping steps. It means knowing your process so well that you can execute it efficiently.”

Lessons from the Ice and the Green

Outside the office, Kinahan’s approach to business mirrors his personal interests — golf and ice hockey. Both sports, he says, demand focus, strategy, and mental resilience.

“In hockey, if you lose your cool, you make mistakes,” he says with a grin. “In investing, it’s the same. The market will test your patience and your confidence. You have to keep your composure and trust your training.”

Golf, meanwhile, gives him space to reset. “Golf humbles you,” he admits. “You can have all the right tools and still misread the wind. It reminds me that preparation and adaptability matter just as much in life as in business.”

Giving Back Through Purpose

For Kinahan, success has always included service. He remains active in philanthropy, supporting local causes in Connecticut and initiatives that promote financial literacy and youth development. “I was fortunate to learn from great mentors,” he says. “It’s important to pass that on — whether it’s through time, resources, or simply being available to help someone get their start.”

He often encourages younger professionals to look beyond short-term goals. “Early in your career, you chase titles and bonuses,” he says. “But over time, you realise your reputation — your integrity — is what lasts. That’s the real asset.”

Looking Ahead: The Human Side of Finance

Despite years in high-stakes environments, Kinahan still sees finance as a people business. Technology, data, and algorithms have changed the landscape, but trust and insight remain at its core.

“Automation is great for efficiency,” he says, “but it doesn’t replace judgment. Clients want to know that someone is looking out for them — someone who understands their goals and the bigger picture.”

That human-first philosophy continues to guide his work at Lake Avenue Capital. “At the end of the day,” he adds, “investing isn’t just about numbers. It’s about building relationships, managing risk, and helping people achieve something meaningful.”

The Takeaway

Shane Kinahan’s story is one of balance — between scale and speed, between data and instinct, between Wall Street’s structure and a boutique firm’s independence. His approach to investment management proves that even in an era of algorithms, there’s still room for experience, integrity, and human insight.

“Markets change,” he says. “But principles don’t. If you stay disciplined, stay curious, and stay humble, the results will follow.”

Add CEOWORLD magazine as your preferred news source on Google News

Follow CEOWORLD magazine on: Google News, LinkedIn, Twitter, and Facebook.License and Republishing: The views in this article are the author’s own and do not represent CEOWORLD magazine. No part of this material may be copied, shared, or published without the magazine’s prior written permission. For media queries, please contact: info@ceoworld.biz. © CEOWORLD magazine LTD